NEW

Press Releases

Exhibition Info

2024.04.26

EV Indonesia 2024に出展します

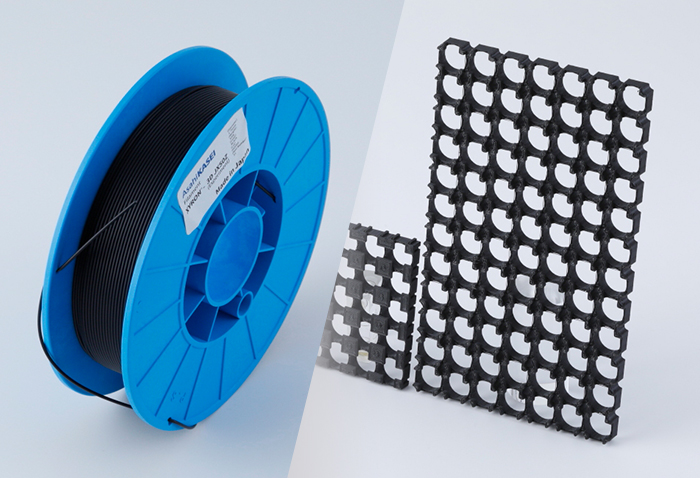

XYRON™ m-PPE resin

Please request SDS and various certificates through a trading company or other purchasing channels.

Information on Asahi Kasei engineering plastics products and related industries

NEW

Industry Columns

Download slides

2024.04.26

NEW

Industry Columns

2024.04.18

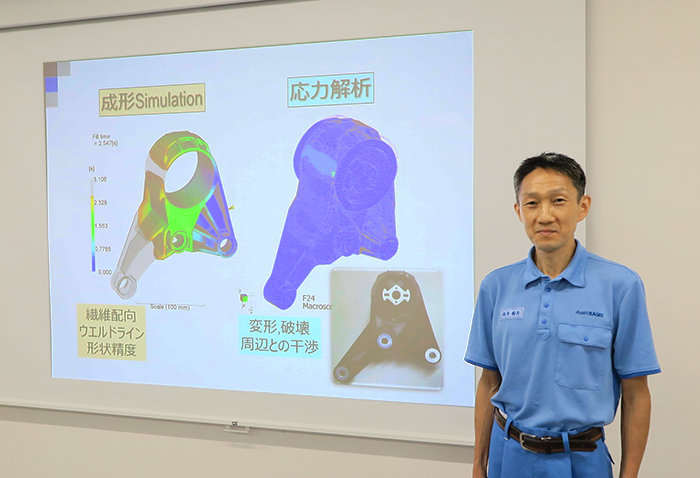

Interviews

2024.02.13

Press Releases

2024.02.01

Press Releases

2023.12.15

PA樹脂 レオナ™

Technologies and Products

2023.11.22

Press Releases

Exhibition Info

2023.12.04

Interviews

2023.11.14

Technologies and Products

2023.11.10

Press Releases

2023.11.02

Press Releases

2023.10.19

Press Releases

Exhibition Info

2023.09.26

Press Releases

Exhibition Info

2023.10.10

Press Releases

2023.09.06

Industry Columns

2023.08.21

Industry Columns

2023.07.07

Technologies and Products

2023.06.23

Exhibition Info

Download slides

2023.06.30

Press Releases

2023.06.08

Press Releases

2023.05.16

Press Releases

2023.06.01

Exhibition Info

2023.05.29

Industry Columns

2023.05.19

Press Releases

Exhibition Info

2023.05.12

Industry Columns

2023.04.07

Press Releases

2023.04.27

Industry Columns

2023.03.09

Exhibition Info

2023.05.22

Industry Columns

2023.02.01

Industry Columns

2022.12.02

Press Releases

Exhibition Info

2022.12.02

Press Releases

2022.11.15

Press Releases

2022.12.14

Interviews

2022.11.14

Industry Columns

2022.10.27

Industry Columns

2022.10.27

Press Releases

2022.10.18

Press Releases

2022.10.11

Press Releases

2022.10.07

Technologies and Products

2022.10.11

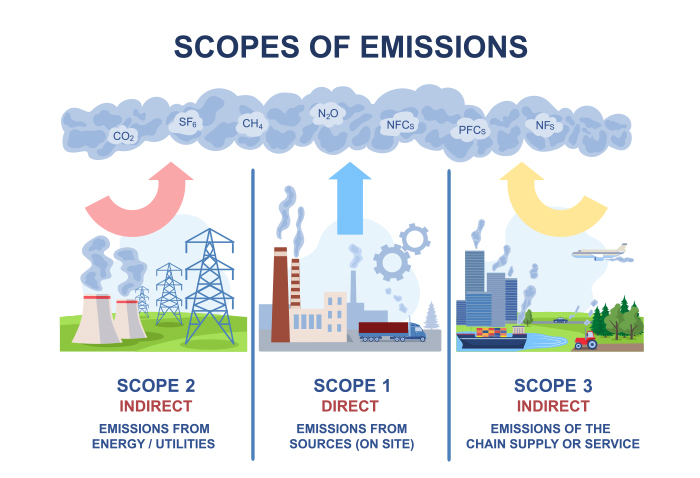

Industry Columns

2022.08.31

Industry Columns

2022.08.31

Press Releases

2022.08.23

Press Releases

Exhibition Info

2022.08.08

Technologies and Products

2022.08.02

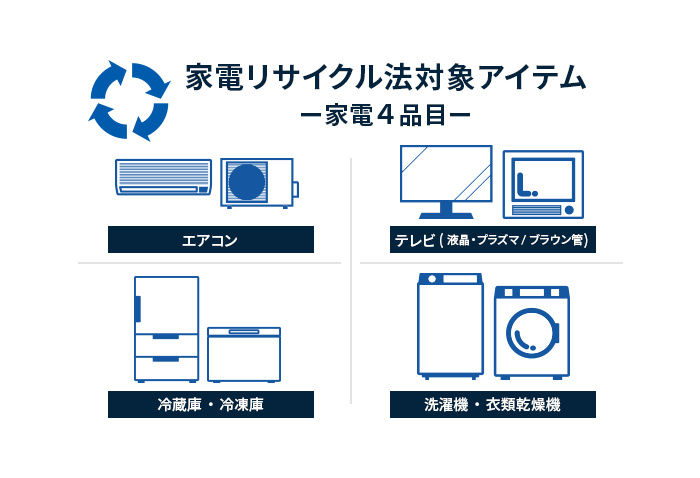

Industry Columns

2022.08.01

Industry Columns

2022.08.01

Industry Columns

2022.07.01

Industry Columns

2022.07.01

Industry Columns

2022.06.09

Industry Columns

2022.06.09

Industry Columns

2022.05.18

Industry Columns

2022.05.18

Press Releases

2022.04.20

Press Releases

2019.05.22

Press Releases

2018.11.09

Press Releases

2022.04.19

Technologies and Products

Download slides

2022.03.28

Press Releases

2022.03.16

Technologies and Products

2022.03.15

Industry Columns

2022.03.02

Technologies and Products

2022.02.14

Press Releases

2021.12.17

Press Releases

Technologies and Products

2022.12.06

Technologies and Products

Download slides

2021.11.10

Technologies and Products

2021.10.15

Technologies and Products

Download slides

2021.09.27

Technologies and Products

Download slides

2021.07.26

Technologies and Products

Download slides

2021.06.22

Press Releases

2021.06.15

Interviews

2021.06.02

Interviews

2021.10.12

Technologies and Products

Download slides

2022.11.22

Interviews

2021.03.24

Technologies and Products

2021.03.29

Technologies and Products

2021.03.29